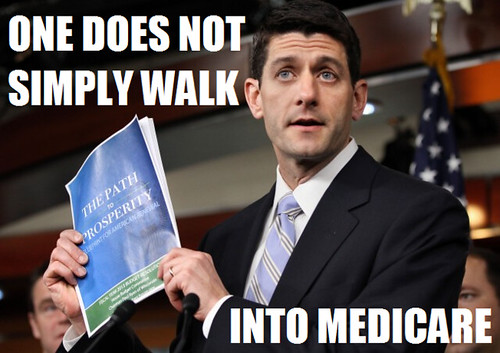

One does not simply walk into Medicare. Its red ink is guarded by more than just Democrats. There is an AARP there that does not sleep, and the Great Grandma is ever watchful. It is a barren wasteland, riddled with demagoguery and deception and despair. The very political discourse you crave is a poisonous fume. Not with ten thousand Tea Partiers could you do this. It is folly.

“There is no worse tyranny than to force a man to pay for what he does not want merely because you think it would be good for him.” – Robert Heinlein

I’m pretty sure the Army of Math reinforced by the Army of Demography will accomplish this task soon enough…

Great pick by Romney. There could be no clearer choice in any election I’ve ever seen. Romney made 20 million bucks in 2010 (that’s the only year of taxes he released) without working an hour in the year for it and paid 15% in taxes on that income, while a guy working 40 hours a week at a fast food place made 35,000 and paid 25% of it in taxes. Isn’t this exactly what the complaint about the unequal tax rate is all about? Rich people don’t pay their fair share, and then Paul Ryan wants to subsidize low tax rates for the rich by cutting the services of our elderly and least fortunate to avoid raising taxes.

That’s madness. We’ve followed the model of Republicans tax structure straight down the toilet, can we please start trying to do something different. Obama should follow through on his promise of actually raising taxes, instead of continuing the Republicans economic policies that got us and kept us in this depression for so long.

can you show us the tax return of this fast food employee who paid $8,750 in taxes on $35K income? if this person exists, he should find a competent person to prepare his taxes for him… might i suggest Tim Geithner? oh wait…

another question: how many shares of the average americans’ federal benefits were funded by Romney’s $3,000,000 in taxes paid (this is working under the assumption that your 15% figure is correct… i haven’t seen Romney’s 2010 tax return)?

also, how much has Romney given to charities in the past several years? and how much has Obama given to charities? and how about Biden?

. Romney made 20 million bucks in 2010 (that’s the only year of taxes he released) without working an hour in the year for it and paid 15% in taxes on that income, while a guy working 40 hours a week at a fast food place made 35,000 and paid 25% of it in taxes, and a “poor” guy received $25,000 in government aid and transfer payments and paid 0% of it in taxes, and in fact receiveda “refund” on taxes he didn’t pay. Isn’t this exactly what the complaint about the unequal tax rate is all about? Poor people don’t pay their fair share,

I think most people around here are at an age to remember being young and broke, and when you’re making 35k a year you don’t pay a few hundred bucks to have an expert tax preparer find all the loopholes to get you back 20 bucks. Remember tax benefits aren’t designed for low-income people. I don’t think they have a lot of write-offs from mortgages, investment losses, business expenses etc. Most broke people use Turbo Tax or H&R block or do it themselves. I know I did it myself back then.

http://taxes.about.com/od/Federal-Income-Taxes/qt/Tax-Rates-For-The-2011-Tax-Year.htm

Another answer: None of Romney’s $3,000,000 in taxes benefited average Americans, that money was used to wash Soldier’s clothes in Iraq for 1 hour. And I’d like to have $17,000,000 dollars without doing 1 days work for it, heck you know what, you could have 50% of it and I wouldn’t complain, but then again I’m a real american.

Romney didn’t give anything to charity. He got his charitable write-offs by giving millions to the mormon church. Donating to Scientology or donating to Mormonism doesn’t benefit any americans but those at the top of the cult.

you really don’t know anything about our tax system, do you? the most this guy would’ve paid is about 9.8%. are you familiar with standard deductions, exemptions, tax brackets, marginal tax rates? did you even read the website you linked to?

you’re right, no tax dollars actually get spent on Americans… just used as sponges in Iraq.

i hope you don’t have any investments to live off when you retire because you’ll be hating yourself for collecting all this money without working for it, and then not paying a ton of taxes on it…

you should go look at Romney’s 2010 return. you’ll see that Romney only gave about half of his charitable contributions to the Mormon church.

do you really believe the crap you type, or are you thinking you’ll be able to convince some uninformed moron of these lies, and so it’s worth a shot?

@#7

Sandy believes the moon landings were faked…’nough said.

i’ve historically been more of an inconsistent seasonal reader/poster here, and each time i return i think i fall into the trap and try to correct Sandy on his (her?) bogus crap… then i remember who I’m trying to talk to and realize it’s best to ignore.

Sully,

Amazing, you have the tax details of a hypothetical person making 35k. I just said when I was younger, making a similar amount I didn’t get any tax write-offs and I wasn’t on government assistance and had H&R block do the taxes, i didn’t get it down to 9.8% or even 15%. I always paid additional taxes above my with-holdings (of which I was my only dependent) on April 15. Now that I make considerably more money I pay virtually no taxes because there are so many loopholes/write-offs for rich people.

The reason I bring up Iraq is because the tax revenue isn’t all “re-distributed” from rich people to poor people or whatever BS republicans try to shovel. A trillion was wasted on wars in Iraq and Afghanistan, and a half trillion is wasted in additional military BS that we don’t need. But Republicans never have a problem with that.

Please, don’t try and compare Mitt Romney to any other American. All the investments I had are gone, and they weren’t in the same Universe as what Romney’s earning in terms of annual income on investment return. You’re talking about making $20,000,000 per year (that we know of (based on his 2010 tax return)) on invested money. The rest of his money, he says is in overseas accounts. Right on his tax return he says his money is in switzerland, so you know he’s got additional income that isn’t being taxed for America.

The only “crap” I’m typing is the information you don’t like to accept, because it’s the truth. A billionaire paying 13.9% income tax is complaining that he’s being over-taxed by that bully Obama. That’s completely pathetic.

If you think anything I’ve said is bogus and needs to be corrected, read Mitt Romney’s tax return at this link:

http://www.washingtonpost.com/business/mitt-romneys-2010-tax-return-romneys-estimated-2011-filing-full-text/2012/01/24/gIQApZ6RNQ_story.html

Any other election and I’d probably agree with Brendan. This time around, however, events may have conspired to allow Republicans to run on Medicare despite all the Democrat demagoguery. Obamacare’s IPAB will soon be in charge of Medicare and we’ll likely see price controls that pay providers even less than they would get for seeing Medicaid patients, adversely affecting access. Moreover, the $ taken out of already-strapped Medicare would then go to fund Obamacare. Add the fact that Romney picked the running mate probably best suited to make the case for Medicare reform, and the fact that we’re that much closer to the program’s insolvency, and you have perhaps the perfect storm of opportunity for Republicans to successfully campaign on Medicare (at least to a draw).

Interesting take on the Medicare debate. The reality of the Medicare financial position will assert itself soon enough, however, and then both parties will be forced to engage.

Sandy, the 9.8% figure is the highest one possible for this “hypothetical” guy. anyone with 30 seconds and a 2nd grade education can figure it out.

$35K income

– $5,700 standard deduction

– $3,650 exemption amount

= taxable income of $25,650.

he pays 10% on each dollar up to $8,375, and 15% on each additional dollar.

total tax paid is $3,428.75. that’s less than 9.8% of $35K.

maybe he has some student loans, and he can deduct interest, which would lower his tax even further.

maybe he has a wife who’s making about the same or less than him… that would lower the percentage even more. on the other hand, maybe he has a wife making more than him… that would raise his percentage paid a bit, but then again he’s no longer in as bad a situation as you were implying for this hypothetical guy.

the only other way the percentage could be higher than 9.8% (assuming his only income is from the fast food job) is if he were claimed as a dependent by someone else… which would once again be a better situation than you were implying.

again, you’re clueless about our tax system. turbo tax really doesn’t require any tax knowledge at all? i’ve never used it, so it’s a serious question.

Sandy, all the bogus crap you’ve said is proven wrong by your own links. the tax brackets link proves your hypothetical guy doesn’t come close to paying 25% as you claimed. the Romney tax return link proves that Romney did in fact give to charity, which you claimed he didn’t.

Also, are you saying that you were a single filer with no other dependents, filled out your W-4 accurately, and didn’t have any other income, yet you had to make additional tax payments with your tax return year after year? unless you skipped one of the automatic deductions, or utilized some bad math or table reading skills, i have a hard time believing that.

The old place looks almost the same – a few improvements – good to see #3 daughter being acknowledged !

As they say “Prediction is the *only* science !” … and science established that the Ryan pick would bring Brendan back to life here …

Sandy is himself, I see, as cogent and well-informed as ever after his hiatus …

I can’t tell if Brendan intends to cast Ms Pelosi or our current First Lady as Shelob – my money is on Pelosi – she already has the bulging eyes for the part …

Ahhh – it’s good to be back !

i apologize Sandy. I was wrong. The highest percentage this hypothetical guy would’ve had to pay is NOT 9.8%. It’s actually 8.65%. I forgot about the Making Work Pay credit.

But hey, at least he’s paying SOMETHING… and more than half of all Americans are paying less than him, with a full half paying nothing. I guess he could reasonably be upset about that injustice.

If everything Sully says is true, then 1) I had really bad people filing my taxes years ago and 2) nobody is paying too much in taxes currently and everything I see from the Republican debates, red faced republican commentators and Fox news is a lie– that people pay too much in taxes (more than 30% of their income).

Although, the link on the article I posted does say that Newt Gingrich paid 31% of his income in taxes and Obama paid 26% of his income in taxes during the same year Mit Romney made about 20 times as much money as them and paid 13.9%, and those are pretty smart guys that seem like they wouldn’t overpay their taxes. So despite my example, it seems like the super rich are paying a lower rate than the regular rich, and that’s not right (which has been my point all along).

As for half of Americans paying nothing, that brings me back to disbelieving everything you’ve written. People who are under 18 or over 65 don’t pay (income) taxes because they don’t work (almost all), People who make less than $23,000 (or whatever the poverty line is at) don’t pay income taxes. Disabled and homeless don’t pay income taxes.

If you think 5 year olds, the mentally handicapped, the impoverished, and 67 year olds should pay their fair share, you just might be a Paul Ryan Republican.

@Sandy,

What is there to believe or not believe? The IRS publishes this data, and it is easy to look up. 46% of US households do not pay any income tax, for example see http://www.urban.org/uploadedpdf/1001547-Why-No-Income-Tax.pdf

This does not cover children as you seem to indicate, this is household based data. I think 5 year olds, the mentally handicapped, etc. should pay their fair share, don’t you? Fair might be zero in some instances, of course.

You can argue that half of US households shouldn’t pay income taxes, and I think we should consider the effects of the significant payroll taxes when looking at the whole picture. However, you can’t have a productive discussion if you don’t understand that a huge fraction of ordinary households just do not pay any net income taxes.

J Stephen Wills #17 – Sandy has a number of difficulties understanding language and concepts …

For example, if one’s income is only from investments, as I understand it, the fed income tax rate is 15% … if from a 9-5 job, then it can go up as high as 36% (not sure about that upper limit) … you and I can guess where Romney’s income currently has its source … Sandy, not so much …

Another example … we are discussing income tax here … yet Sandy manages to conflate income tax and tax on incomes, two concepts which have overlap yet not identity … those of us who believe that “that people pay too much in taxes (more than 30% of their income).” are aware that there are more taxes we have to pay than just income taxes .. again, Sandy, not so much …

Third example … “because there are so many loopholes/write-offs for rich people.” … Sandy has yet to grasp that raising the rate of income tax on the rich doesn’t matter the proverbial hill of beans when they can turn round and hide significant portions of their income in ways not available to the less-well-paid … tax deduction for mortgage interest on first homes (up to say $1 million in first mortgage loan value) would keep the bias towards more people being able to afford their own houses while not subsidising the Buffets and Hollywood crowd as much, for example …

Fourth example – call it the Kerry Fix, perhaps … have a federal sales tax on the purchase of movable property with a value over $5 million … so that a yacht costing $7.5 million would hae tax paid on its purchase no matter where one chose to moor it to avoid paying sales tax … after all, such a tax would hit the Koch Brothers just as hard, would it not ?

Oh – and, if you have not yet encountered our resident davidkian, you have a treat in store almost comparable to Sandy … (innocent grin) …

I happened across some Brenddan-bait a short time ago here …

I’m curious what our regulars think about what Mr Sowell writes ?